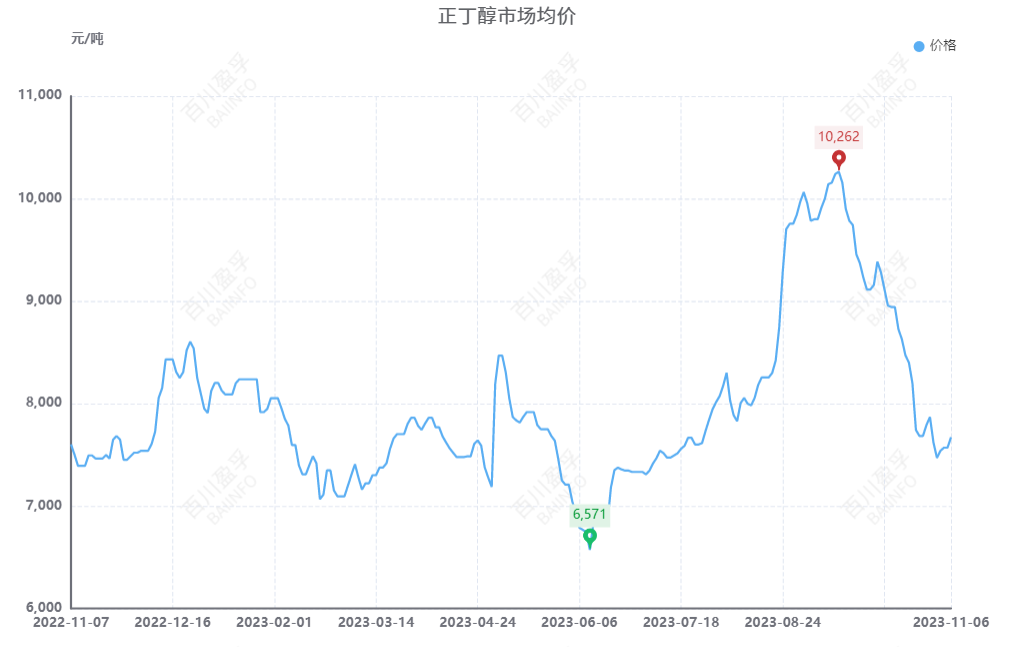

Fis-6 ta' Novembru, il-fokus tas-suq tal-n-butanol żdied 'il fuq, bi prezz medju tas-suq ta' 7670 wan/tunnellata, żieda ta' 1.33% meta mqabbel mal-jum tax-xogħol ta' qabel. Il-prezz ta' referenza għaċ-Ċina tal-Lvant illum huwa 7800 wan/tunnellata, il-prezz ta' referenza għal Shandong huwa 7500-7700 wan/tunnellata, u l-prezz ta' referenza għaċ-Ċina t'Isfel huwa 8100-8300 wan/tunnellata għal kunsinna periferali. Madankollu, fis-suq tal-n-butanol, fatturi negattivi u pożittivi huma marbutin ma' xulxin, u hemm lok limitat għal żidiet fil-prezzijiet.

Minn naħa waħda, xi manifatturi waqfu temporanjament għall-manutenzjoni, u dan irriżulta fi tnaqqis relattiv fil-prezzijiet spot tas-suq. L-operaturi qed ibigħu bi prezzijiet għoljin, u hemm lok għal żieda fil-prezz tas-suq tal-n-butanol. Min-naħa l-oħra, impjant tal-butanol u l-oktanol f'Sichuan reġa' nfetaħ, u d-distakk fil-provvista reġjonali ġie rifornit minħabba ż-żieda fil-prodotti fil-futur. Barra minn hekk, l-irkupru tal-impjanti tal-butanol f'Anhui nhar l-Erbgħa wassal għal żieda fl-operazzjonijiet fuq il-post, li għandu ċertu impatt negattiv fuq it-tkabbir tas-suq.

Min-naħa tad-domanda, l-industriji tad-DBP u tal-aċetat tal-butil għadhom fi stat ta’ profitt. Immexxija min-naħa tal-provvista tas-suq, il-konsenji tal-manifatturi għadhom aċċettabbli, u l-intrapriżi għandhom ċerta domanda għall-materja prima. Il-fabbriki ewlenin tas-CD downstream għadhom jiffaċċjaw pressjoni fuq l-ispejjeż, bil-biċċa l-kbira tal-intrapriżi fi stat ta’ pparkjar u s-suq ġenerali jopera f’livell baxx, li jagħmilha diffiċli biex id-domanda tiżdied b’mod sinifikanti. B’mod ġenerali, l-entużjażmu għall-akkwist downstream bi prezz baxx u meħtieġ biss huwa relattivament tajjeb, filwaqt li t-tfittxija tal-fabbrika għal prezzijiet għoljin hija dgħajfa, u n-naħa tad-domanda għandha appoġġ moderat għas-suq.

Għalkemm is-suq qed jiffaċċja xi fatturi sfavorevoli, is-suq tal-n-butanol jista' xorta jibqa' stabbli fi żmien qasir. L-inventarju tal-fabbrika huwa kontrollabbli, u l-prezzijiet tas-suq huma stabbli u qed jogħlew. Id-differenza fil-prezz bejn il-polipropilene downstream ewlieni u l-propilene hija relattivament dejqa, fit-tarf tal-profitt u t-telf. Riċentement, il-prezz tal-propilene kompla jiżdied, u l-entużjażmu għas-suq downstream biex jiddgħajjef gradwalment illimita l-appoġġ għas-suq tal-propilene. Madankollu, l-inventarju tal-fabbriki tal-propilene għadu fi stat kontrollabbli, li għadu jipprovdi xi appoġġ għas-suq. Huwa mistenni li l-prezz tas-suq tal-propilene fi żmien qasir jistabbilizza ruħu u jiżdied.

B'mod ġenerali, is-suq tal-materja prima tal-propilene huwa relattivament b'saħħtu, u l-kumpaniji tal-akkwist downstream bi prezzijiet baxxi huma dgħajfa fl-insegwiment tagħhom ta' prezzijiet għoljin. L-unità Anhui n-butanol waqfet għal żmien qasir, u l-operaturi fuq medda qasira ta' żmien għandhom mentalità qawwija. Madankollu, meta l-unitajiet min-naħa tal-provvista jiġu restawrati, is-suq jista' jiffaċċja r-riskju ta' tnaqqis. Huwa mistenni li s-suq tal-n-butanol l-ewwel jogħla u mbagħad jaqa' fuq medda qasira ta' żmien, b'varjazzjonijiet fil-prezzijiet ta' madwar 200 sa 400 wan/tunnellata.

Ħin tal-pubblikazzjoni: 07 ta' Novembru 2023